California Democratic Party Passes Public Banking Resolution

Medium – By Ben Hauck. On July 15th 2018, the California Democratic Party (CDP) passed a resolution supporting socially and environmentally responsible, state-chartered public banks. The state party resolution is a significant milestone for the public banking movement, as the CDP represents over 8.7 million registered Democrats.

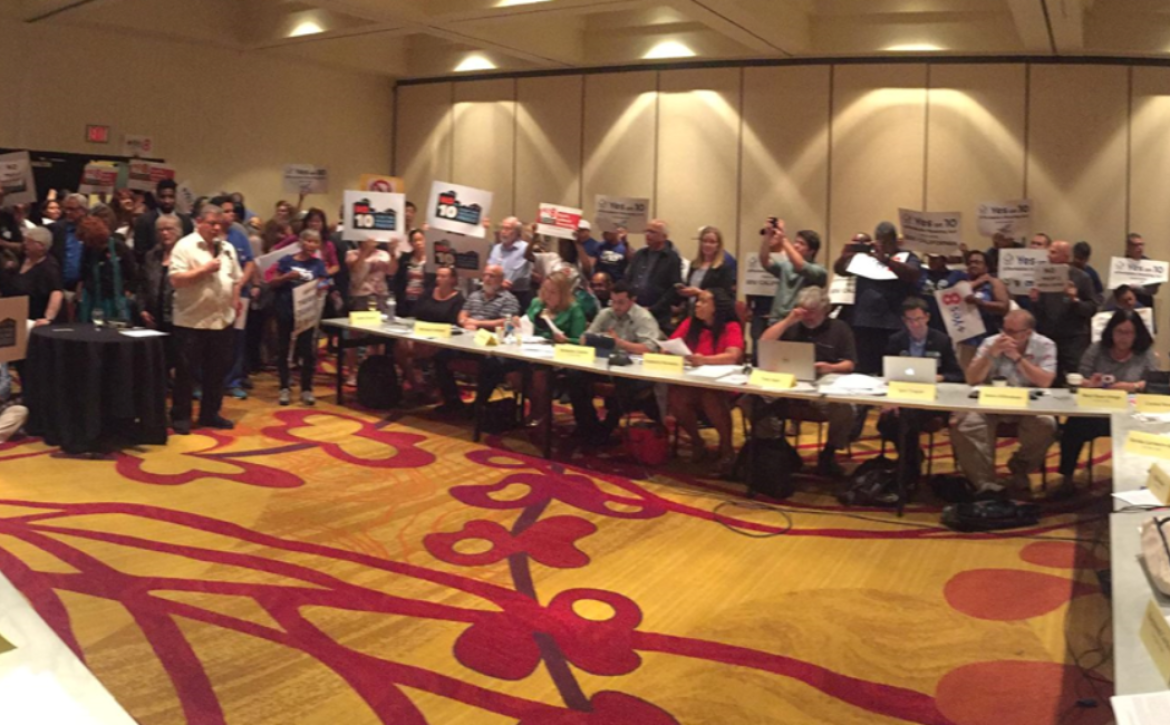

The resolution was originally presented by Feel the Bern Democratic Club, Los Angeles with the support of public banking advocacy group Public Bank LA (PBLA). After passing unanimously through the Los Angeles County Democratic Party in April 2018, the resolution was passed during the California Democratic Party Executive Board meetings in Oakland this weekend.

Public Bank LA co-founder Trinity Tran states, “The California Democratic Party’s resolution endorsement is a significant step to elevate publicly-owned banks as a top priority issue for the mainstream. The solutions to many of the problems that stem from privately-controlled banks can be addressed through public banking. It’s a common sense approach for local-control and self-determination of our public finances.”

Los Angeles City Council President Herb Wesson and six councilmembers introduced an exploratory public banking motion in July 2017, following the City’s divestment from Wells Fargo bank. Wesson and council members took further action on June 26, 2018, unanimously passing a motion that will add a measure on the November 2018 general election ballot that would amend the city charter, removing a barrier to creating a city-owned bank. This will put the fate of public banking in the hands of Los Angeles voters.

Continue reading on Medium.